SOFTWARE

mykohlscard – Everything You Need to Know

If you’re a Kohl’s fan, you should consider applying for the retailer’s co-branded credit card. It offers rewards and discounts, though the complicated system can be confusing if you’re new to it.

To sign up, visit the Kohl’s website and click on “My Kohl’s Card.” Enter your 12-digit card number in the box under the “Register Now” option. You’ll need to pass security checks before you can use your account.

Rewards and discounts

mykohlscard offers a number of rewards and discounts for its cardholders. These include 35% off on your first purchase, an extra 15% off, exclusive offers and birthday gifts. You can also sign up for Yes2You and Kohl’s Cash accounts to earn additional discounts.

While the benefits of mykohlscard aren’t as great as the rewards offered by other retail store cards, the discounts can help save you money on your purchases at Kohl’s. However, you should be aware that the card’s rewards structure is quite complex and you will have to keep track of it in order to make the most of your savings.

Whether you are shopping in-store or online, the mykohlscard app is packed with features that allow you to browse and shop the latest deals, rewards and coupons from your favorite stores. You can also manage your account on the go, making it easy to pay your bill and stay on top of your spending.

The mykohlscard offers many ways to save on your purchases, but it’s important to understand the terms and conditions before you apply. For example, if you have a low credit score, you may need to use a secured card instead of an unsecured one.

In addition to the rewards and discounts that are offered by mykohlscard, it also offers a number of other perks. For instance, if you spend $600 in a single year on your card, you will become a Most Valued Customer and receive special offers throughout the year.

This is a very nice offer for customers who are frequent shoppers at Kohl’s. However, it isn’t a good choice for those who aren’t loyal to the store.

The mykohlscard offers a number of different ways to save on your purchases, but it’s not a good choice for those who aren’t faithful to the store. For example, if you have shopped at Kohl’s a lot in the past, you may be better off getting a regular cash back card or a rewards card that offers cash back on all of your department store purchases.

Online account management

Online account management is a service that allows customers to view their accounts and make payments without visiting the store. It is available 24 hours a day and features top-rated customer service. It also offers discounts and rewards to help customers save money while shopping at Kohls.

Account management is a critical component of any sales strategy. It helps you cultivate long-term relationships with your clients, which can lead to increased revenue and referrals. In addition, it improves client retention, which can lower operating costs and increase profit margins.

In many cases, account managers are the main contact point for a company’s client base. They resolve conflicts, facilitate communications between clients and the company’s sales and support teams, and help ensure that the client’s needs are met.

The importance of account management cannot be overemphasised, and it’s an important part of every successful business. It’s important for companies to identify and nurture key accounts, as these relationships are the ones that produce most of a company’s revenue.

Managing these accounts requires a lot of detailed information. This information includes the account’s status, goals, and threats. This data helps you create forecasts, track milestones towards goals, and monitor opportunities related to your key accounts.

There are several different types of account management software, each designed to work for a particular purpose. Zoho CRM, for example, provides a range of tools to manage an account’s contacts, deals, and tasks.

Another tool is KAM (key account management) software, which is designed to collect and save a large amount of detailed information about specific accounts. It’s important for account managers to stay up to date on this information so they can provide the best possible service to their clients.

This tool is often used to manage larger enterprise accounts and accounts with cyclical sales and renewal processes. It also allows users to grant customised access to additional employees, allowing them to either view or transact from their accounts.

It’s important to note that account management is a complex process, and it involves strategic business techniques that require a high level of skill and experience. It’s essential for companies that want to build strong client relationships and avoid losing valuable customers to competitors.

Paperless billing

If you’re a Kohl’s charge card member, you can sign up for paperless billing at mykohlscard. The site is free to use and provides access to statements, transactions, account balances, and other information. Customers can also update their account information, including their address and phone number.

Improved security: Paper billing involves printing and mailing sensitive information to customers, which can lead to a number of risks and headaches. With paperless billing, businesses can send their account information directly to customers’ emails or online accounts, minimising the chance of this information being lost or stolen along the way. This translates to faster payments, better reminders, and more efficient troubleshooting should anything go wrong in the process.

To sign up for paperless billing at mykohlscard, customers need to visit the website and follow a few simple steps. First, they should enter their 12-digit Kohl’s card number and last name into the new register. Once this is done, they’ll be prompted to answer verification questions. Once they’ve passed those, they’ll be given their account username and password.

Cancellation request

My Kohl’s card offers customers a variety of benefits, including rewards and discounts on purchases at their stores. They also offer a number of online services, such as account management and paperless billing. They even offer travel insurance, which can be very useful in the event of a trip cancellation. If you’re looking to close your card, it’s easy to do so. To do so, you need to contact customer service and provide your account number and a valid email address. Once they’ve received your request, they’ll process it within five business days.

The website also offers a couple of other cool-looking services, including the ability to make payments online and an interestingly shaped card that can be used in store. However, the best of these is probably the online account management function. It can be especially helpful if you’re trying to keep your credit score low, and it also allows you to track your spending and make payments.

Also Read: Techalphanews.com

SOFTWARE

New Software 418DSG7: The Ultimate Tool for Business Productivity

Technology is constantly evolving, and businesses need efficient tools to stay competitive. New software 418DSG7 is a cutting-edge solution designed to enhance productivity, streamline workflows, and improve collaboration. It caters to individuals, small businesses, and large enterprises looking for a seamless work experience.

The software is known for its intuitive design, making it easy for users to adapt without extensive training. With a focus on automation and integration, it helps reduce manual tasks and ensures a smooth digital workflow. This makes it an ideal choice for professionals who want to save time and increase efficiency.

One of the biggest advantages of new software 418DSG7 is its ability to work across multiple devices. Users can access their data anytime, anywhere, making it a great tool for remote workers and global teams. This feature ensures that businesses remain productive even when employees are not in the same location.

Additionally, the software offers strong security features to protect sensitive information. With encrypted storage and access controls, users can trust that their data remains safe from unauthorized access. These security measures make it a reliable option for businesses dealing with confidential data.

Core Features of 418DSG7

One of the key highlights of new software 418DSG7 is its user-friendly interface. The layout is designed to be intuitive, allowing users to navigate easily without technical expertise. The simplified design reduces the learning curve, making it accessible to beginners and experienced professionals alike.

Another significant feature is advanced collaboration tools, which help teams work together more efficiently. It includes real-time document editing, shared workspaces, and integrated messaging options. These tools ensure that teams can communicate and complete tasks without delays.

Automation capabilities make repetitive tasks easier to manage. Users can automate reports, data entry, and notifications, reducing the need for manual intervention. This feature is particularly useful for businesses handling large amounts of data, as it minimizes errors and improves accuracy.

- Seamless integration: Works with existing tools like Microsoft Office, Google Workspace, and CRM software.

- Cloud-based accessibility: Ensures that users can work from any device with an internet connection.

- Customization options: Allows businesses to tailor the software to their specific needs.

These features make new software 418DSG7 a versatile solution for improving workflow efficiency and team collaboration.

Benefits of Using 418DSG7

One of the primary benefits of new software 418DSG7 is its ability to enhance productivity. By automating repetitive tasks, employees can focus on more critical projects, leading to better time management and improved output. The software reduces workload stress and increases operational efficiency.

Another key advantage is cost efficiency. Businesses often spend a significant amount of money on multiple software solutions to handle different tasks. With 418DSG7, users can consolidate multiple functions into a single platform, cutting costs and improving workflow efficiency.

Project management becomes more effective with the built-in tracking and organization tools. Managers can assign tasks, monitor progress, and set deadlines within the software. This feature helps teams stay on schedule and ensures accountability.

- Scalability: Whether a business is small or growing, the software adapts to its changing needs.

- Security: Strong encryption and data protection ensure that sensitive information remains safe.

- User-friendly experience: Minimal training is needed, making it accessible for all users.

These benefits make new software 418DSG7 a powerful tool for individuals and businesses looking for a comprehensive digital solution.

Use Cases of 418DSG7

For businesses, the software serves as an essential tool for managing teams, automating workflows, and improving communication. Whether it’s tracking progress or sharing files, 418DSG7 provides all the necessary features in one platform.

Freelancers and remote workers can also benefit from new software 418DSG7. It allows users to organize projects, collaborate with clients, and access files from anywhere. The cloud-based system ensures work continuity regardless of location.

IT and development teams find it useful for integrating with other software applications. It supports API connections, making it easy to link with existing business tools. This feature allows IT professionals to create a customized tech environment without limitations.

- Educational institutions: Teachers and students can use it for document sharing, class management, and real-time collaboration.

- Healthcare and legal professionals: Secure file storage and automation reduce administrative workload.

These use cases demonstrate how new software 418DSG7 adapts to different industries and user needs.

How to Get Started with 418DSG7

Setting up new software 418DSG7 is a simple process. Users can download and install it on their devices without technical assistance. The installation guide provides clear instructions, ensuring a smooth setup.

For those unfamiliar with the software, a range of user training resources is available. Video tutorials, documentation, and customer support services help new users navigate the platform efficiently.

The software offers a free trial, allowing users to explore its features before committing to a paid plan. Pricing plans vary based on usage needs, making it a flexible solution for different budgets.

With a straightforward installation, training resources, and flexible pricing, new software 418DSG7 is accessible to businesses and individuals looking for a powerful yet easy-to-use solution.

Future Updates and Developments

Developers are constantly working to improve new software 418DSG7, ensuring it stays up to date with industry needs. Future updates aim to introduce AI-driven automation, making tasks even faster and more efficient.

The company plans to expand integration capabilities, allowing the software to work seamlessly with more third-party applications. This improvement will help businesses streamline their digital tools.

Security updates will also be a major focus. As cyber threats evolve, the software will introduce stronger encryption and authentication measures to protect user data.

With continuous updates and feature enhancements, new software 418DSG7 is expected to become even more powerful and versatile in the future.

Conclusion

New software 418DSG7 is a game-changer for businesses, freelancers, and professionals looking for a seamless workflow solution. It offers a wide range of features, from automation to collaboration tools, making it a valuable addition to any workspace.

The software is designed to be user-friendly and scalable, ensuring that businesses of all sizes can benefit from its capabilities. Whether it’s improving productivity, enhancing security, or managing projects, it provides an all-in-one solution.

With strong security features and cloud accessibility, users can trust that their data is safe while working from anywhere. As technology continues to evolve, new software 418DSG7 will keep advancing to meet the demands of modern businesses.

For those looking to simplify their work processes and increase efficiency, new software 418DSG7 is the perfect solution.

FAQs

What makes New Software 418DSG7 different from other business tools?

It combines automation, collaboration, and cloud accessibility in one platform, reducing the need for multiple software solutions.

Is New Software 418DSG7 suitable for small businesses?

Yes, it is scalable, affordable, and designed to meet the needs of both small businesses and large enterprises.

Does the software offer data security features?

Absolutely! It includes encryption, secure cloud storage, and access control to protect sensitive information.

Can I integrate New Software 418DSG7 with other tools?

Yes, it supports seamless integration with platforms like Microsoft Office, Google Workspace, and CRM software.

Is there a free trial available before purchasing?

Yes, users can access a free trial to explore its features before committing to a subscription.

SOFTWARE

Exploring the Lead in to Lingo: How Understanding Context Can Enhance Communication

Introduction to the importance of communication

Communication is the lifeblood of all relationships – whether personal or professional. It’s the bridge that connects us, allowing ideas to flow and connections to be made. But what if I told you that there’s a hidden layer in communication, a secret code that can unlock deeper understanding and richer conversations? Welcome to the world of context – where words morph their meanings, gestures speak volumes, and cultural nuances add layers of complexity. Join me on this journey as we explore how understanding context can truly enhance our communication skills and take our lingo game to new heights!

The impact of context on communication

Context plays a pivotal role in shaping the way we interpret and convey messages. The setting, the people involved, and the timing can all significantly influence how communication unfolds. Imagine telling a joke at a funeral versus at a comedy club – the context drastically alters its reception.

Even simple phrases like “I’m fine” can have varying meanings based on context; it could indicate genuine well-being or conceal deeper emotions. In professional settings, using industry-specific jargon may enhance understanding among colleagues but Lead in to Lingo to confusion outside that context.

Nonverbal cues such as facial expressions and body language also contribute to contextual communication. A smile may denote happiness in one situation but nervousness in another. Understanding these subtleties is key to effective interaction across diverse contexts.

Cultural nuances further highlight the impact of context. What’s acceptable in one culture might be taboo in another, emphasizing the need for sensitivity and awareness when communicating cross-culturally.

Examples of how context can change the meaning of words and phrases

Have you ever heard someone use the phrase “I’m dying” after a particularly funny joke? In this context, it’s not meant to be taken literally; it’s actually expressing that they found something hilarious. Now imagine if you took those words at face value without considering the context – it would Lead in to Lingo to confusion or concern!

Another example is the phrase “break a leg.” While in a theatrical setting, it’s seen as wishing someone good luck before a performance. However, outside of that context, telling someone to break their leg would definitely elicit some puzzled looks.

Even simple words like “fine” can have different meanings based on the situation. Saying you’re fine when asked how you are could indicate everything from truly feeling okay to hiding your true emotions.

Understanding these nuances shows just how crucial context is in shaping our communication and avoiding misunderstandings.

Understanding nonverbal cues and body language in different contexts

When it comes to communication, words are just one part of the puzzle. Nonverbal cues and body language play a significant role in conveying meaning and emotions. Imagine someone saying they’re fine with a smile, but their crossed arms and furrowed brow tell a different story.

In different contexts, nonverbal cues can have varying interpretations. A nod may indicate agreement in one culture but signify disagreement in another. Understanding these subtle signals is key to effective communication across diverse settings.

Gestures like hand movements or eye contact can also change meanings based on context. In some cultures, maintaining direct eye contact shows respect; in others, it may be seen as confrontational.

Body language nuances can impact how messages are received and understood. Being aware of these subtleties helps us navigate conversations more effectively, fostering better connections with others.

How cultural context affects communication

When it comes to communication, cultural context plays a significant role in shaping how messages are interpreted. Different cultures have unique norms, values, and beliefs that influence the way individuals communicate. For example, gestures that are considered positive in one culture may be offensive in another.

Language nuances can vary greatly across different cultures, leading to misunderstandings if not taken into account. The use of idioms or slang can also differ widely, impacting the clarity of communication between people from diverse cultural backgrounds.

Moreover, hierarchical structures within societies can affect how people interact with each other. In some cultures, direct communication is valued while others prefer indirect approaches to avoid conflict or maintain harmony.

Understanding the cultural context is essential for effective cross-cultural communication and building strong relationships based on respect and understanding. It requires openness, empathy, and a willingness to learn about different customs and traditions to bridge potential gaps in communication effectively.

Tips for improving contextual awareness in communication

When it comes to improving contextual awareness in communication, there are several key tips that can help you navigate conversations more effectively. First and foremost, actively listen to the other person and pay attention to their tone of voice, facial expressions, and body language. These nonverbal cues can provide valuable context for understanding their message.

Another tip is to consider the cultural background of the person you are communicating with. Different cultures may have varying norms around communication styles, gestures, and even personal space. Being aware of these differences can prevent misunderstandings and promote smoother interactions.

Additionally, be mindful of your own biases and assumptions during conversations. It’s important to approach each interaction with an open mind and a willingness to adapt your communication style based on the context at hand.

Practice empathy in your communication efforts. Try to see things from the other person’s perspective and validate their feelings before responding. This level of understanding can go a long way in building rapport and fostering meaningful connections through effective communication strategies.”

Conclusion on the benefits of understanding context for effective communication

Understanding the intricacies of context in communication is like unlocking a hidden treasure trove of meaning and connection. By delving into the layers of context, we can navigate conversations with finesse, empathy, and precision. This heightened awareness allows us to decode subtle cues, avoid misunderstandings, and foster deeper relationships.

So, as we embark on this journey from lead in to lingo, let’s remember that context is not just background noise—it’s the very essence that gives language its power. Embrace the nuances of context in your interactions, and watch how understanding transforms mere words into bridges that connect hearts and minds.

SOFTWARE

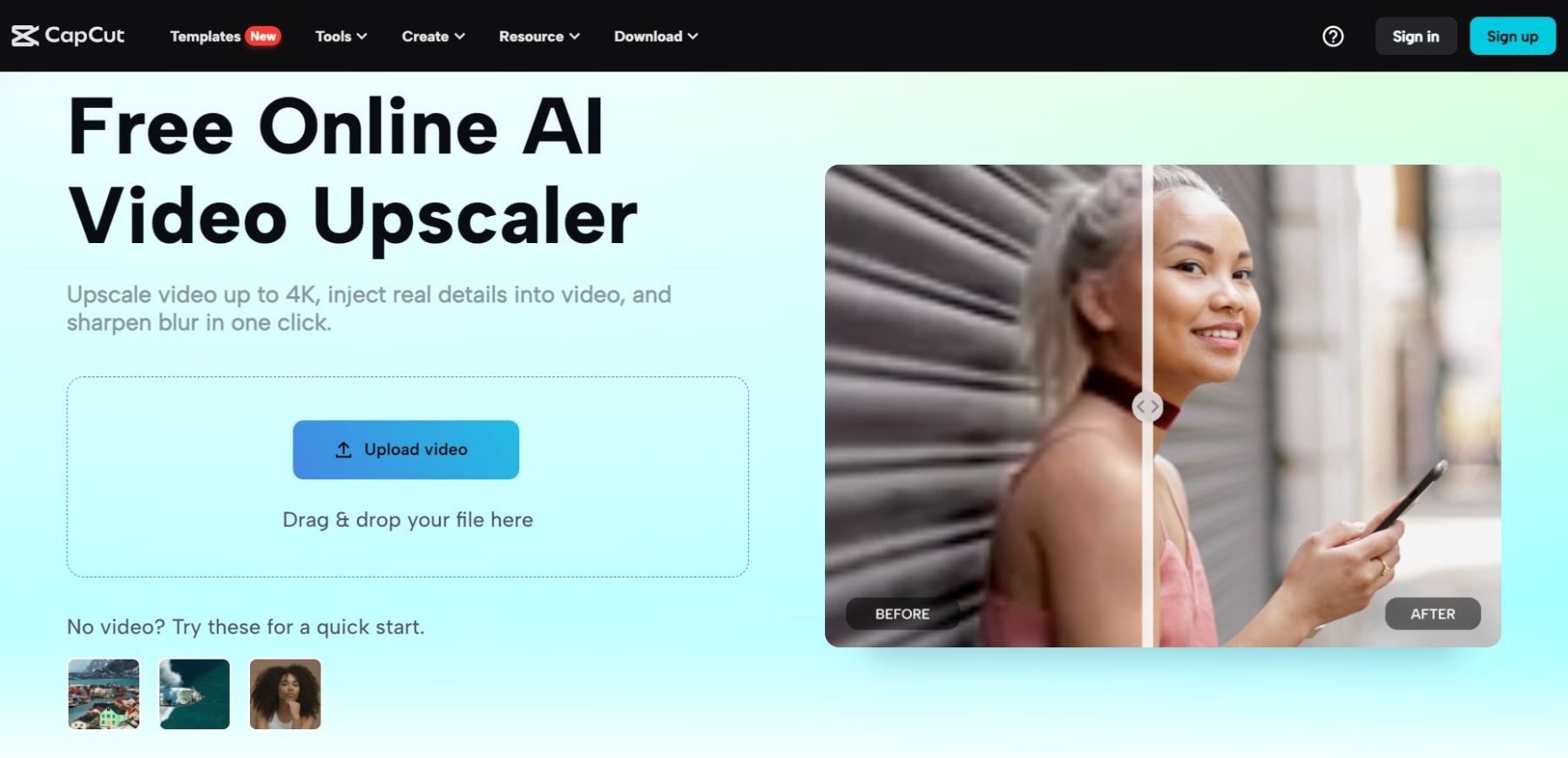

How to Use CapCut Video Upscaler for Professional-Looking Videos: Tips and Tricks

Are you looking to elevate the quality of your videos and stand out in a crowded digital world? Look no further than CapCut Video Upscaler. This powerful tool can transform your content into professional-looking masterpieces with just a few clicks. Whether you’re a content creator, marketer, or simply someone who loves making videos, CapCut Video Upscaler is here to take your visuals to the next level. Let’s dive into how you can harness the full potential of this game-changing software!

What is CapCut Video Upscaler?

it is a cutting-edge tool designed to enhance the quality of your videos by upscaling them to higher resolutions. This software uses advanced algorithms to analyze and improve the clarity, sharpness, and overall visual appeal of your footage. By utilizing artificial intelligence technology, CapCut Video Upscaler can effectively increase the resolution of your videos while maintaining a high level of detail.

Whether you’re working on personal projects or professional content creation, CapCut Video Upscaler can help you achieve that polished look that sets your videos apart from the rest. With its user-friendly interface and powerful features, this tool makes it easy for anyone to elevate their video quality without needing extensive technical expertise.

Say goodbye to grainy visuals and hello to crisp, professional-looking videos with CapCut Video Upscaler at your fingertips!

Why should you use CapCut Video Upscaler for your videos?

Are you looking to take your video content to the next level? CapCut Video Upscaler might just be the tool you need to enhance the quality of your videos effortlessly. With its advanced upscaling technology, CapCut is designed to improve the resolution and clarity of your footage, making it look more professional and polished.

By using CapCut Video Upscaler, you can transform ordinary videos into high-definition masterpieces that will captivate your audience. Whether you’re a content creator, filmmaker, or social media influencer, incorporating this tool into your editing process can elevate the overall look and feel of your videos.

Say goodbye to pixelated images and blurry scenes – with CapCut’s upscaling capabilities, you can achieve sharp details and vibrant colors that will make your visuals stand out. Don’t settle for mediocre quality when you have the power of CapCut Video Upscaler at your fingertips.

Step-by-Step Guide on Using CapCut Video Upscaler

Step 1: Start by opening the CapCut app on your device. If you don’t have it yet, download it from the app store and install it.

Step 2: Import the video you want to upscale into CapCut. You can either select a video from your phone’s gallery or record a new one directly within the app.

Step 3: Once your video is loaded, tap on the editing tools icon and select “Video Upscaler” from the options available.

Step 4: Adjust the settings according to your preferences. You can choose the desired resolution and quality for your upscaled video.

Step 5: Preview your upscaled video to ensure you are satisfied with the results. Make any necessary adjustments before saving or exporting it.

Step 6: Save or export your final upscaled video in high resolution to share with others or use in professional projects.

Tips for Getting the Best Results with CapCut Video Upscaler

Looking to elevate your video content with CapCut Video Upscaler? Here are some tips to help you get the best results possible:

Always start by selecting the highest resolution source footage available. The better the quality of your original video, the more impressive the upscaled result will be.

Next, experiment with different upscaling settings within CapCut to find what works best for each specific clip. Play around with options like AI-based upscaling or manual adjustments to see which one gives you the desired outcome.

Additionally, pay attention to details like lighting and color grading before upscaling your videos. Ensuring these elements are well-balanced can significantly enhance the final quality of your footage.

Furthermore, consider using filters and effects sparingly after upscaling to maintain a professional look. Sometimes less is more when it comes to post-processing enhancements.

Don’t forget about audio quality! Make sure that any accompanying sound matches the upscale visuals for a cohesive viewing experience.

Advanced Features and Techniques for Professional-Looking Videos

If you’re looking to take your video editing skills to the next level, CapCut Video Upscaler offers a range of advanced features and techniques that can help elevate your content. One such feature is the ability to adjust color grading and lighting effects with precision, allowing you to create a more visually appealing final product.

Another powerful tool in CapCut Video Upscaler is its AI-powered enhancement technology, which can improve the quality of low-resolution footage by upscaling it while minimizing noise and artifacts. This can be particularly useful when working with older or lower-quality source material.

For those looking to add a professional touch to their videos, CapCut Video Upscaler also offers advanced editing options such as customizable transitions, motion graphics, and text overlays. These elements can help make your videos more engaging and polished, leaving a lasting impression on your audience.

By exploring these advanced features and techniques within CapCut Video Upscaler, you can unlock new creative possibilities and refine your editing skills for truly professional-looking videos.

Common Mistakes to Avoid when Using CapCut Video Upscaler

When using CapCut Video Upscaler, it’s essential to avoid common mistakes that could impact the quality of your videos. One mistake to steer clear of is overusing the upscaling feature. While it can enhance video resolution, excessive upscaling may result in a loss of sharpness and clarity.

Another common error is neglecting to adjust other settings like brightness, contrast, and saturation after upscaling. It’s important to fine-tune these aspects for a balanced and professional-looking outcome. Additionally, failing to save your progress periodically during the editing process can lead to potential data loss if the app crashes unexpectedly.

Furthermore, forgetting to optimize your video for different platforms can hinder its reach and engagement. Each platform has specific requirements for resolution and aspect ratio that should be considered before exporting your video. Rushing through the editing process without previewing your work can cause overlooked errors or inconsistencies that could have been easily corrected beforehand.

By being mindful of these common pitfalls when using it, you can elevate the quality of your videos and create content that truly stands out online.

Final Thoughts on Using CapCut Video Upscaler for Professional Videos

After exploring the various features, tips, and techniques for using CapCut Video Upscaler to enhance your videos professionally, it’s evident that this tool can truly take your content to the next level. By leveraging its upscaling capabilities, you can significantly improve the quality of your footage without compromising on clarity or sharpness.

Whether you’re a seasoned video editor looking to refine your work or a beginner seeking to elevate your content creation game, It’s offers an intuitive and effective solution. With its user-friendly interface and advanced features, this tool empowers users to transform ordinary videos into polished masterpieces with ease.

By following the step-by-step guide, implementing best practices for optimal results, exploring advanced techniques, and avoiding common mistakes when using it, you can unlock its full potential and create professional-looking videos that captivate audiences and leave a lasting impression.

So why wait? Elevate your video editing skills today with CapCut Video Upscaler and watch as your content shines brighter than ever before. Experiment with different settings, unleash your creativity, and let this powerful tool help you achieve stunning results that set you apart in the competitive world of digital media. Harness the power of technology to bring your vision to life in high definition – because when it comes to creating standout videos, every detail counts.

-

L,IFESTYLE2 years ago

L,IFESTYLE2 years agoExploring the Heart of Iowa City Downtown District

-

TECH2 years ago

TECH2 years agoMaximizing Your Pixel 6a’s Wireless Charging Performance: Tips and Tricks

-

SPORTS3 years ago

SPORTS3 years agoclub america vs deportivo toluca f.c. timeline

-

CRYPTO2 years ago

Features of Liquidity Providers and Differences Between Them

-

BUSINESS2 years ago

BUSINESS2 years agoThe Evolution of the Patagonia Logo: A Look at the Brand’s Iconic Emblem

-

TECH3 years ago

TECH3 years agoBuild Your Email Marketing Contact

-

TECH3 years ago

TECH3 years ago6 Ways AI Will Change the Future of Marketing

-

HEALTH7 months ago

HEALTH7 months agoProstavive Colibrim: A Natural Prostate Health Supplement